Understanding Electricity Procurement: Captive, Group Captive, and Exchange

The Traditional Approach vs. Modern Solutions

Traditionally, businesses receive electricity from a licensed distribution company (DISCOM) in their area. This is often the simplest option, but it can limit flexibility, expose businesses to volatile retail tariffs, and restrict access to renewable energy sources. Modern procurement methods offer alternatives that can lead to significant cost savings, greater control over supply, and improved sustainability

1. Captive Power Procurement

What it is: Captive power procurement involves a company generating electricity primarily for its own consumption. This can be achieved through owning and operating a power plant (e.g., a solar farm, a wind turbine, or a gas-fired plant) directly on its premises or at an off-site location with a dedicated transmission line. The key characteristic is that at least 26% of the ownership must reside with the entity consuming the power, and they must also consume at least 51% of the power generated.

Benefits:

-

Cost Savings: Avoids DISCOM charges and open access charges, potentially leading to lower per-unit electricity costs.

-

Reliability & Quality: Greater control over power supply, quality, and voltage. Reduces dependence on the grid for primary power.

-

Sustainability: Easier to integrate renewable energy sources and meet corporate sustainability goals.

-

Energy Security: Reduces exposure to grid outages and tariff fluctuations.

Considerations:

-

Capital Investment: Requires significant upfront investment in power generation assets.

-

Operational Responsibility: The company is responsible for the operation, maintenance, and fuel procurement for the plant.

-

Regulatory Compliance: Navigating environmental and power sector regulations can be complex.

2. Group Captive Power Procurement

What it is: Group captive is an evolution of captive power, designed for multiple industrial or commercial consumers to jointly own and operate a power plant. This allows smaller or medium-sized businesses that might not have the individual consumption or capital to set up a sole captive plant to benefit from similar advantages. In a group captive arrangement, multiple consumers collectively hold the 26% ownership and consume the 51% of generated power, with each participant typically having an equity share proportional to their energy consumption.

Benefits:

-

Reduced Capital Outlay: Spreads the upfront investment across multiple participants, making it more accessible.

-

Economies of Scale: Larger plant size often leads to lower per-unit generation costs and more efficient operation.

-

Shared Responsibility: Operational and regulatory burdens are distributed among the participants.

-

Similar Advantages to Captive: Access to cheaper, reliable, and often greener power compared to grid supply.

Considerations:

-

Coordination Challenges: Requires effective coordination and agreement among multiple stakeholders.

-

Governance Structure: A robust governance and operational agreement is essential for smooth functioning.

-

Consumption Alignment: Participants' energy consumption patterns should ideally align to maximize benefits.

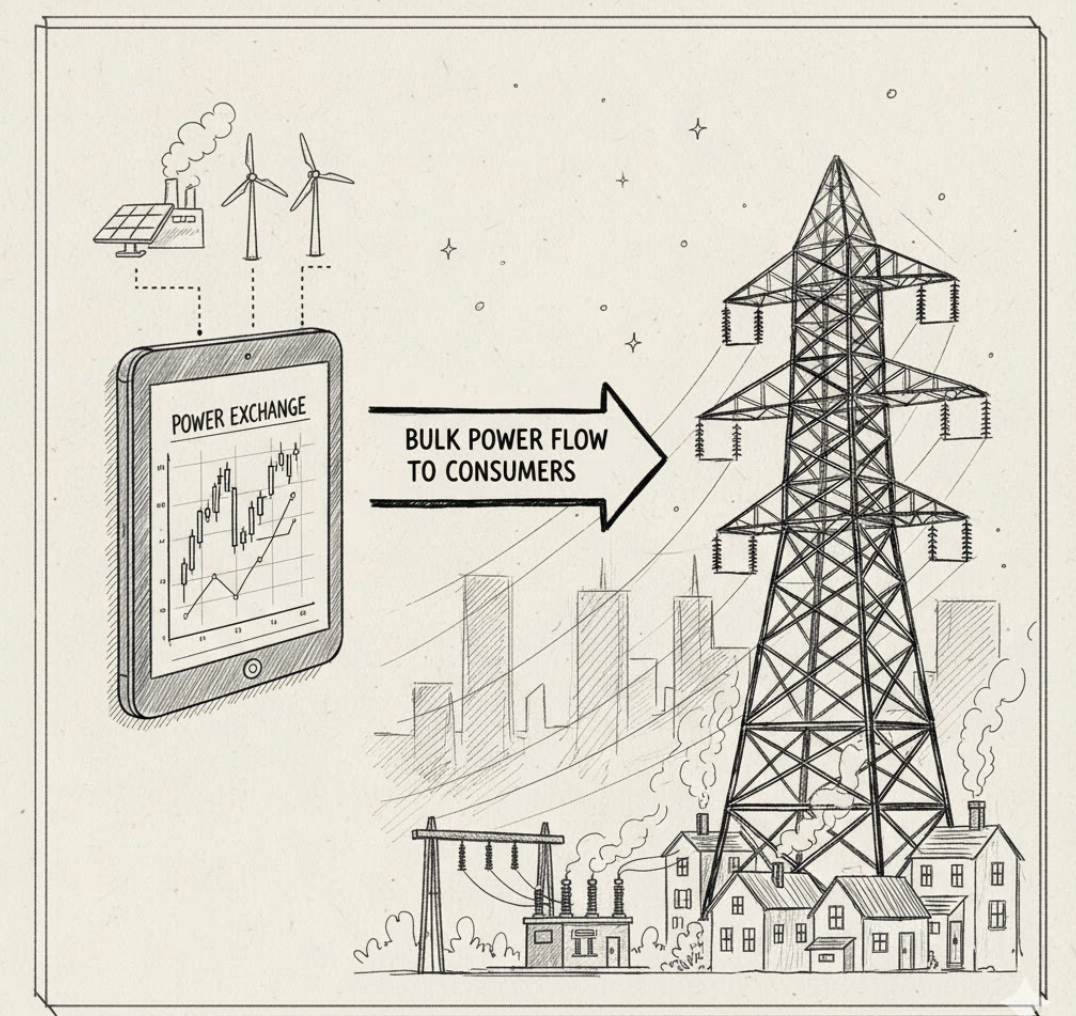

3. Exchange Procurement (Power Exchanges)

What it is: Exchange procurement refers to buying and selling electricity through a centralized power exchange platform. These platforms operate like stock exchanges, facilitating the trade of electricity between generators and consumers (or their intermediaries) in various market segments (e.g., day-ahead, real-time, term-ahead markets). This mechanism allows consumers to procure power directly from the market, often bypassing the long-term Power Purchase Agreements (PPAs) or relying solely on DISCOMs.

Benefits:

-

Flexibility: Allows businesses to buy power for short durations or in response to immediate needs, offering high flexibility.

-

Competitive Pricing: Prices are determined by supply and demand, potentially leading to more competitive tariffs than fixed DISCOM rates.

-

Market Transparency: Real-time price discovery and transparent trading mechanisms.

-

Access to Diverse Sources: Opportunity to procure power from a wide range of generators across the grid.

Considerations:

-

Price Volatility: Market prices can fluctuate significantly based on demand, supply, and external factors.

-

Requires Expertise: Navigating power exchange markets effectively often requires specialized knowledge or an energy management partner.

-

Open Access Charges: Still typically involves transmission and distribution charges from the grid operator.